From raw data to clear, explainable signals —built for long-term decisions

We combine historical data, structured scoring, and transparent logic to help you understand why an investment looks strong or weak—before you act.

No predictions. No black boxes. Just disciplined analysis you can trust.

Get an app and register

Start with downloading and registering an account with Mero Retirement to begin your investor journey.

Tell us your goals

We use your timeline, comfort level and experience to build a personalized strategy.

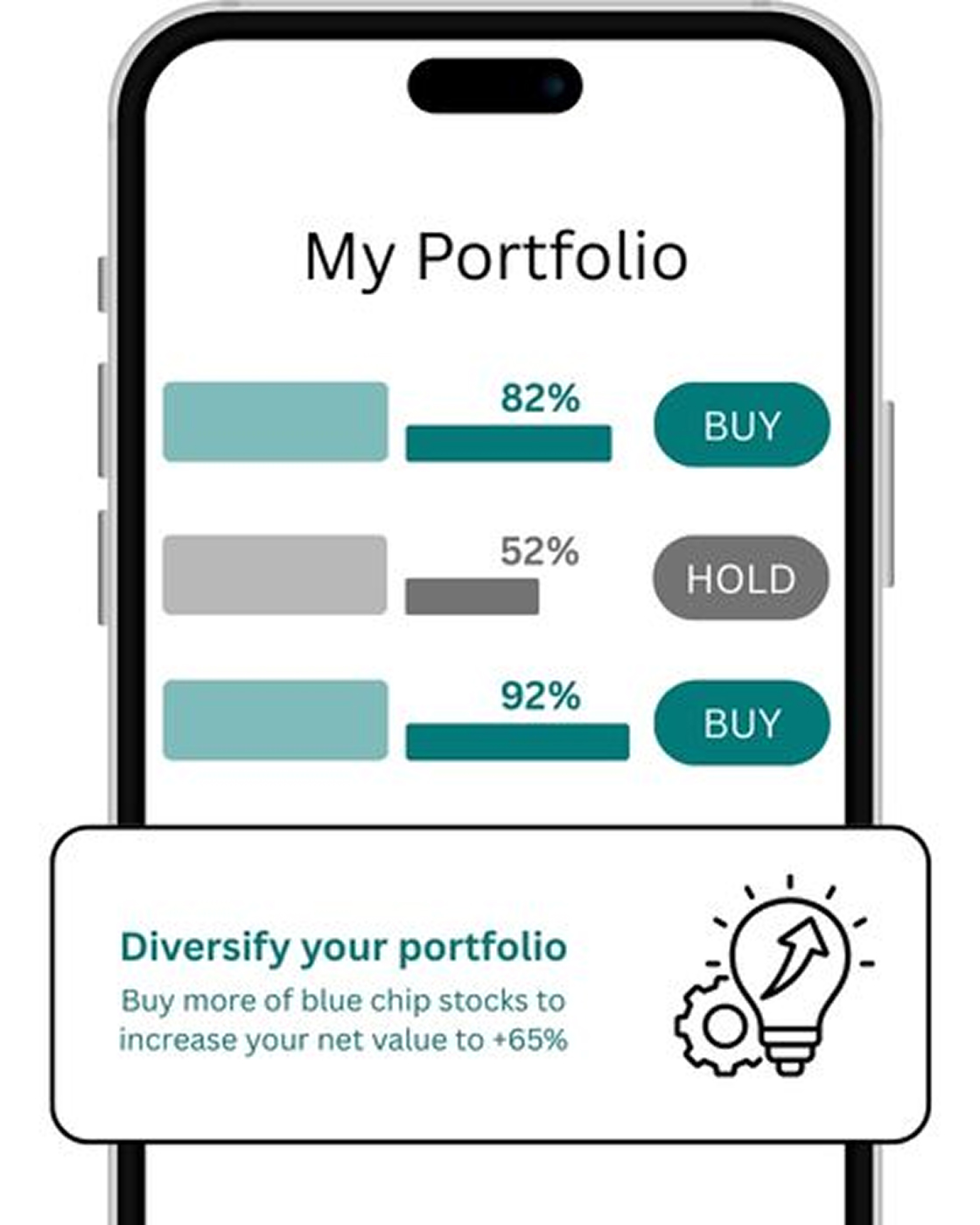

Get your personalized investing plan

See the stocks and investing strategies that will help you reach your goals faster.

From Data to Clear Signals

It starts with real data

We collect historical and current market data across fundamentals, business strength, and technical indicators. Every metric is tied to its source and timestamp, so inputs are always traceable

Covers US-listed equities and ETFs

Data freshness shown per metric

No synthetic or inferred data points

Why it matters

Reliable signals start with verifiable inputs.

Metrics are scored, not guessed

Each company is evaluated using weighted scoring models across multiple categories. Scores are normalized on a 0–100 scale, making comparisons consistent across companies and time.

Category scores (0–100)

A final composite score

Simple ratings: Strong / Good / Neutral / Weak

Why it matters

Structure replaces gut feeling.

Context refines the signal

We collect historical and current market data across fundamentals, business strength, and technical indicators. Every metric is tied to its source and timestamp, so inputs are always traceable.

Context adjusts signal strength, not direction

Event impact is time-bound, not permanent

Fundamentals remain the primary driver

Why it matters

Markets move with context, but fundamentals anchor decisions.

Signals are explained in plain language

Every Buy, Hold, or Sell signal includes clear reasoning in everyday language, visibility into the most influential metrics, and a “what changed since last time” comparison.

Explanations are generated alongside scores

Changes are tracked between updates

No unexplained jumps or silent revisions

Why it matters

Understanding builds confidence and consistency.

You stay in control

Mero Retirement does not execute trades or push actions. The platform supports review and reflection, not impulsive decisions.

No trading or brokerage integration

No forced alerts or nudges

Settings are adjustable anytime

Why it matters

Good investing is deliberate, not automated.

Mero Retirement is for investors who value clarity, consistency, and understanding over short-term excitement.

Be one of the first 1,000 to try out our Signal Engine for free.

Get notified when our app launches at the end of Q1 2026

- 0

- 3

- 5

- 6

and Counting .......

Got Questions

Everything you need to know about Mero Retirement

How accurate are the signals?

Our engine maintains 94% accuracy across market conditions.

What data powers the analysis?

Real-time market feeds combined with historical pattern recognition.

Can I use it on mobile?

Yes, a dedicated app is available for both desktop and mobile platforms.

How often do signals update?

Fresh signals arrive every fifteen minutes during the trading hours.

Is there a free trial available?

Yes, you can start with a free account that offers limited access to exchanges and assets

What if I need help?

Our support team responds within hours to any question.